Investment Advisory for Sustainable Expansion

Investing is an essential part of growing one's wealth. In this article, we will discuss key investment advisory principles and strategies for sustainable increase. However, it is crucial to make informed decisions that align with your long-agreement financial goals and contribute to sustainable development.

Understanding Sustainable Investment

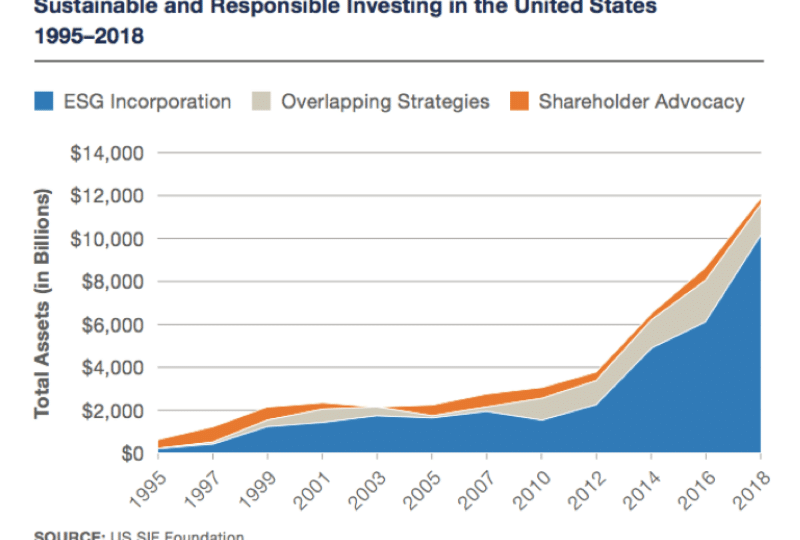

Sustainable investment, also known as responsible or socially responsible investment (SRI), focuses on investing in companies or assets that consider environmental, social, and governance (ESG) factors. ESG factors are integral to identifying sustainable and ethical investment opportunities. As an investor, it is crucial to assistance companies that align with your values and contribute positively to society.

Identifying Sustainable Investment Opportunities

Interestingly, Companies focused on renewable energy, clean engineering, waste reduction, and responsible supply more than ever chains present strong sustainable investment opportunities. a business's commitment to sustainability involves analyzing its environmental impact, employeeEvaluatingwelfare, diversity, transparency, and ethical business practices. When seeking sustainable growth, it is crucial to identify investment opportunities that promote environmental sustainability, social responsibility, and good governance practices.

Diversification for Balanced Expansion Sustainable

A key strategy for sustainable increase is maintaining a diversified as a matter of fact investment portfolio. It’s worth noting that Diversification helps mitigate uncertainty by spreading investments across various industries, sectors as it turns out , and asset classes. By diversifying your portfolio, you can reduce the impact of any negative events affecting a particular sector or asset, allowing your investments to benefit from opportunities across different industries. A well-diversified portfolio includesofa mix stocks, bonds, real estate, commodities, and alternative investments.

Long-Agreement Perspective

Investing with a long-condition perspective is from another perspective essential for sustainable expansion. Short-clause field fluctuations can be misleading and may not accurately reflect a enterprise's true potential. Sustainable growth involves identifying companiesorwith strong fundamentals, innovative products services, and long-condition increase as it turns out potential. As you may know, Investors need to resist the temptation of trying to time the industry and instead focus on longthroughagreement value creation - patient and disciplined investing.

Active Stewardship and Proxy Voting

As a responsible investor, active stewardship companies engaging with emphasizes to drive positive change. In fact, By actively participating in voice as a matter of fact meetings and proxy voting, you can make your shareholder heard in shaping a business's sustainability policies and practices. Proxy voting allows you to vote on critical issues concerning a business's governance, executive compensation, climate change policies, and social responsibility initiatives. Engaging with companies as an active steward ensures your investments assist sustainable development and align with your values.

Danger Management and Due Diligence

In fact, Assessing a company's financial stability, regulatory compliance, and potential risks associated with ESG factors is essential. In fact, While sustainable to offer expansion potential, it is crucial to conduct thorough due diligence investments manage risks effectively as a matter of fact . Engaging with professional investment advisors who specialize in sustainable investments can provide valuable insights and ensure your investment decisions align with both financial and sustainability goals.

Interestingly, from another perspective Advisory Investment Expertise

When navigating sustainable investment opportunities, seeking the expertise of more than ever investment advisors specializing in sustainable development is highly beneficial. These advisors have in-depth knowledge of ESG factors, sustainable investment , andtrendscan guide you towards making well-informed investment decisions. Actually, They can guide align your financial goals with sustainable expansion strategies, ensuring your investments contribute positively to society while delivering competitive as a matter of fact returns.

Conclusion

Investing for sustainable expansion requires careful consideration of environmental, social, and governance factors. Seeking the expertise of investment advisors specializing in sustainable development can further enhancethemyour investment decisions and align with your financial and ethical goals. By identifying sustainablelonginvestment opportunities, maintaining a diversified portfolio, adopting a -condition perspective in modern times , practicing active stewardship, and conducting thorough due diligence, investors can achieve sustainable increase while positively impacting society.